Gross vs Net: Understanding the Key Differences

Introduction

When dealing with salaries, payments, sales, and weights, the terms "gross" and "net" often come up. Understanding the difference between gross and net is essential for financial planning, business decisions, and budgeting. In this article, we’ll break down the differences in various contexts to help you make informed decisions.

What Do Gross and Net Mean?

Definition of Gross

"Gross" refers to the total amount before any deductions. Whether it’s income, weight, or sales, the gross figure is the starting point before taxes, fees, or other costs are subtracted.

Definition of Net

"Net" is the amount left after deductions. This is the actual figure you take home or use after all necessary costs are subtracted.

Gross vs Net in Different Contexts

1. Gross Pay vs Net Pay

What is Gross Pay?

Gross pay is the total salary or wages earned before deductions like taxes, social security, and benefits.

Example:

If an employee’s gross pay is $5,000 per month but after deductions for taxes and insurance they receive $3,800, then the net pay is $3,800.

What is Net Pay?

Net pay is the actual amount an employee receives after deductions.

Which One is Better?

-

Gross pay shows your earning potential.

-

Net pay represents your actual spending money.

-

Net pay is more important for budgeting.

2. Gross Salary vs Net Salary

-

Gross salary includes bonuses, overtime, and allowances before deductions.

-

Net salary is what you take home after taxes and other deductions.

Example:

If a job offers a gross salary of $60,000 per year, but after income tax and social security deductions, the employee receives $48,000, then $48,000 is the net salary.

3. Gross Wages vs Net Wages

-

Similar to salary, gross wages refer to total earnings before deductions.

-

Net wages are the final amount employees receive.

Example:

A part-time worker earns $20 per hour and works 40 hours, making a gross wage of $800. After deducting $100 for taxes, the net wage is $700.

Gross vs Net in Business Transactions

4. Gross Sales vs Net Sales

Gross Sales

Gross sales refer to total revenue before deductions like returns, discounts, and allowances.

Example:

A store sells $10,000 worth of products in a month. After deducting $1,000 in discounts and returns, net sales amount to $9,000.

Net Sales

Net sales are the actual earnings after removing these deductions.

5. Gross Payment vs Net Payment

Gross payment is the full amount due before deductions, while net payment is the final amount received after all deductions are made.

Example:

A freelancer invoices a client $1,500 for a project, but after transaction fees of $50, they receive a net payment of $1,450.

6. Gross Lease vs Net Lease

-

Gross Lease: The landlord covers most expenses, and the tenant pays a fixed amount.

-

Net Lease: The tenant pays rent plus additional costs like maintenance and property taxes.

Example:

A tenant pays $2,000 in a gross lease, covering rent, utilities, and maintenance. In a net lease, the tenant pays $1,500 in rent plus $500 for utilities and maintenance.

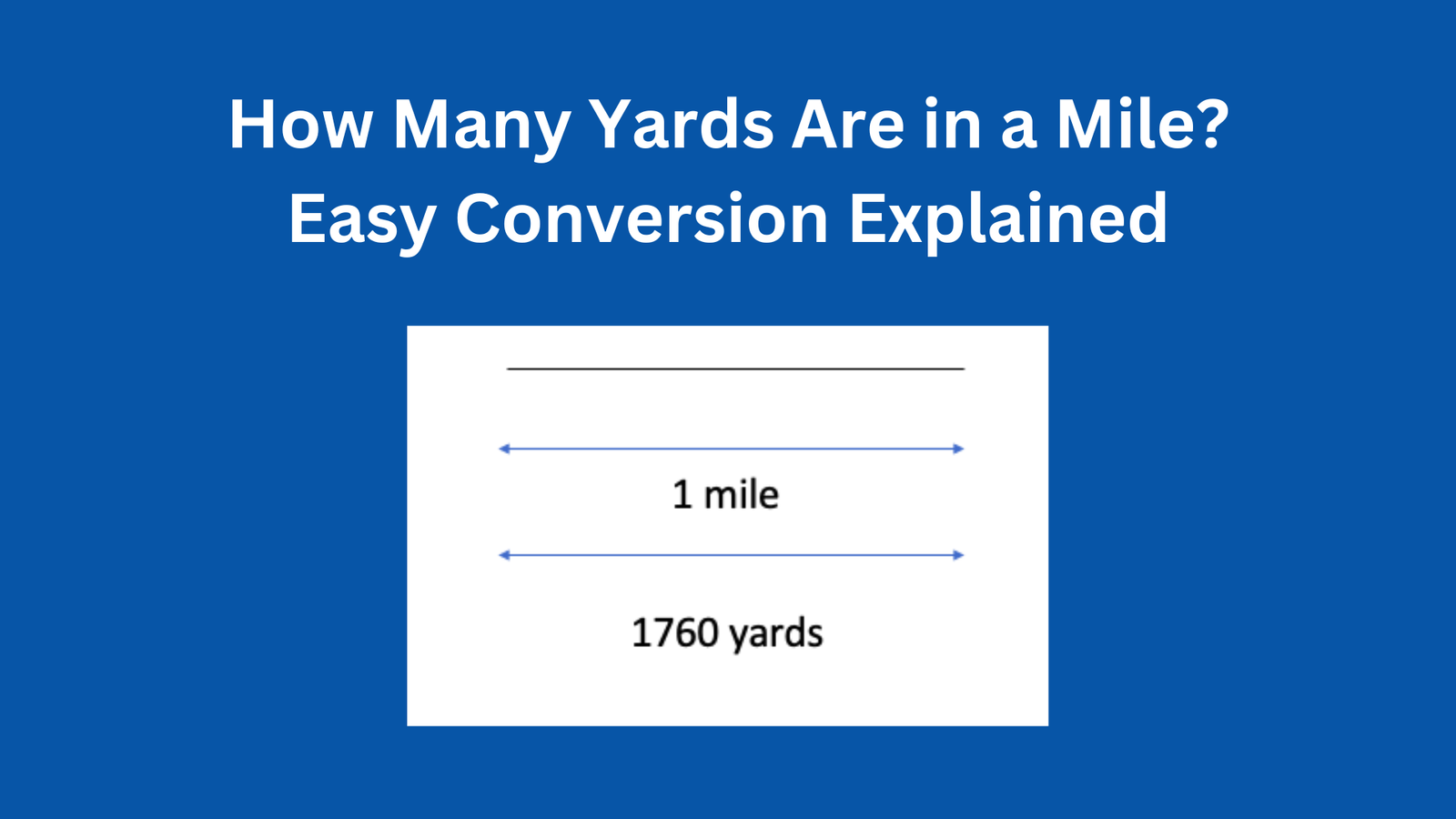

Gross vs Net in Weight and Shipping

7. Gross Weight vs Net Weight

-

Gross Weight: The total weight including packaging.

-

Net Weight: The actual weight of the product without packaging.

Example:

A bag of rice weighs 5.5 kg with packaging. The rice itself weighs 5 kg, so 5 kg is the net weight.

8. Net Weight vs Gross Weight: Which Matters More?

-

Net weight is crucial for consumers.

-

Gross weight is important for shipping and logistics.

Example:

When buying food, net weight matters more since it's the actual edible portion, whereas for shipping, gross weight is more important for calculating costs.

Key Takeaways

-

Gross is the total before deductions.

-

Net is the actual amount after deductions.

-

Understanding these terms helps in salary negotiations, business decisions, and financial planning.

Conclusion

Whether you’re an employee checking your salary, a business owner calculating revenue, or a consumer looking at product weight, knowing the difference between gross and net is essential. These terms impact finances, legal agreements, and everyday transactions. By understanding them, you can make better decisions and plan more effectively.

FAQs

1. Why is net pay lower than gross pay?

Net pay is lower than gross pay because deductions such as taxes, social security, and benefits are subtracted before the final payment is made.

2. How can I calculate my net salary from gross salary?

To calculate your net salary, subtract all applicable taxes, deductions, and benefits from your gross salary.

3. Why do businesses focus on net sales instead of gross sales?

Net sales provide a clearer picture of actual revenue after accounting for returns, discounts, and allowances, which is important for profitability.

4. What is the main difference between gross weight and net weight?

Gross weight includes the product and packaging, while net weight is only the product’s weight.

5. Which is better, gross lease or net lease?

It depends on the situation. A gross lease is simpler with fixed costs, while a net lease can be beneficial if the tenant can control expenses efficiently.

No comments yet! Why don't you be the first?